- ITR refund status 2024 – Itr refund status e filing portal pan card

- General Details For E Filing Portal Online

- Income Tax Department – tin.tin.nsdl.com refund status

- Details Required For www.incometax.gov.in Login

- Types of Services Available With E Filing Portal

- Income Tax Department Registration Details.

- Check out e-Filing portal – response to confirm/revise claim of refund

- Steps To Check the Income Tax Refund Status

- Important Links For response for refund confirmation

[ITR Refund Status, E Filing Portal] response to confirm/revise claim of refund {efiling}. Verify correctness in your claim to ensure consistency with amounts reported by your employer in form 16. e filing portal pending action worklist. Check it is seen that you have claimed large exemption under section 10.

Applicants can check out the itr home page to check out the ITR Refund Status. Response to confirm/revise claim of refund details will be available on the E Filing Portal. It is mandatory for the applicants to do the ITR Login Page. Further details candidates have to read out the given below.

ITR refund status 2024 – Itr refund status e filing portal pan card

Income Tax Portal is an online portal that is launched by the Income Tax Department. The department comes under the guidance of the Ministry of Finance, Government of India. The mission of launching the online portal is to provide single-window access to income tax-related services for taxpayers and other stakeholders. Applicants who have filed the income tax return can able to check the ITR Refund Status here. The mode of checking the status is an online mode. For further details, candidates have to read the given below article.

General Details For E Filing Portal Online

| Authority Name | Income Tax Department |

| Comes Under | Government of India |

| Available For | Tax Related Services |

| Beneficiaries | All taxpayers and stakeholders |

| Year | 2024 |

| Mode to check status | Online mode |

| Category | Status Check |

| Helpline Number | 1800 103 0025 |

| Official website | income.gov.in |

Income Tax Department – tin.tin.nsdl.com refund status

क्या आप आईटीआर रिफंड स्थिति की जांच करना चाह रहे हैं? तो फिर आप स्थिति जांचने के लिए सही जगह हैं। आयकर विभाग आवेदकों को आईआरटी रिफंड स्थिति की जांच करने और ई-फिलिंग दाखिल करने के लिए आमंत्रित कर रहा है। स्टेटस चेक करने का तरीका ऑनलाइन मोड है जो इसकी आधिकारिक वेबसाइट पर उपलब्ध है। हम आपके लिए आईटीआर ई फिलिंग का आधिकारिक लिंक साझा कर रहे हैं। अधिक विवरण जानने के लिए उम्मीदवारों को नीचे दिया गया लेख पढ़ना होगा।

Details Required For www.incometax.gov.in Login

Candidates can check out the details which are required for income tax login which are given below.

- Username

- Password

Types of Services Available With E Filing Portal

Applicants who are taking the benefits of the E Filing online portal can able to check out the types of services which are available here.

- Authenticate notice/order issued by ITD

- e-Verify return

- Tax information and services

- e-Pay tax

- Link Aadhaar status

- Verify your PAN

- Know TAN details

- Know your AO

- Instant E-PAN

- Verify service request

- Link Aadhaar

- Income tax return

- Income tax calculator

- Account misuse

- TDS on cash withdrawal

- Submit information on tax evasion or benami property.

Income Tax Department Registration Details.

There are various types details which are needs to e filling registration which are given below.

- Get Started

- Fill Details

- Verify Details

- Secure Your Account

Check out e-Filing portal – response to confirm/revise claim of refund

- Candidates have to open a income tax official website.

- A homepage of the e-Filing Portal on the homepage.

- Click on it. Find out Pending Action.

- Then find out Worklist Response for Refund Confirmation and select the correct option.

- Click on the Submit Button.

- You are completed with the ITR Refund Response to confirm.

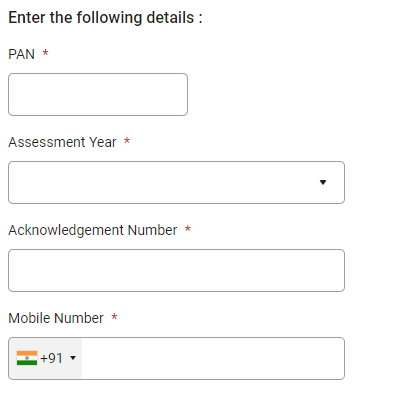

Steps To Check the Income Tax Refund Status

Applicants can go through the process of checking the ITR Refund Status which is given below. We have mentioned the process at here.

- You have to open an official website for the income tax.

- On the homepage, you have to find the Know Your Payment Status link.

- Click on it. Now applicants have to enter their PAN number, CRN Number, and Mobile Number.

- Again click on the Continue Button.

- Your ITR Refund Statu will be get appear on your screen.

Important Links For response for refund confirmation

Check out ITR Refund Status – Click Here