- Refund Awaited Status in ITR 2023 – Income Tax Login

- Collect Details for Refund Awaited Status in ITR 2023

- Refunf Awaited meaning in ITR – e filling itr

- Income Tax Refund Status Online Eligibility criteria

- NSDL Refund Status Calculation of Income Tax Refund

- Refund Awaited Status in ITR 2023

- Steps to file Refund Awaited in ITR

- Important Links For ITR Login 2023

(Meaning) Refund Awaited Status in ITR 2023 – Income Tax Return NSDL ITR Login. Check E Filing Refund Awaited But Not Received Meaning 2023.

Refund Awaited Status in ITR 2023 – Income Tax Department provides an online tool tracking your refund and progress. Ten days after refund has been sent, taxpayers can check status return. To verify you must insert your PAN number and choose Assessment Year. To receive your income tax refund you must complete e-filing. Quicker tax refund make sure to file electronically year.

Refund Awaited Status in ITR 2023 – Income Tax Login

You may be eligible an income tax refund advanced tax or tax deducted at source (TDS) exceeds amount you are required to pay. ITR refunds are a technique to guarantee you get any additional tax you paid back. Through online income tax refunds government has made process simple. Typically takes 20 to 45 days your income tax refund to be processed once you have filed your IT returns and confirmed them.

Collect Details for Refund Awaited Status in ITR 2023

| Authority Name | Income Tax Department |

| Well Known | ITR |

| Year | 2023 |

| Available For | Taxpaying |

| Mode of Applying | Online Mode |

| Category | Online Portal |

| Session | 2023-24 |

| Beneficiary | All taxpayers which are available. |

| Taxes Based On | Income Tax Refund Status Online |

| Official Website | www.onlineservices.nsdl.com |

Refunf Awaited meaning in ITR – e filling itr

एक व्यक्ति कभी-कभी अधिक करों का भुगतान कर सकता है जितना उन्हें करना चाहिए। यह गलत आयकर गणना या स्रोत पर रोके गए कर का परिणाम हो सकता है। ऐसी परिस्थितियों में आप इनकम टैक्स रिफंड के पात्र हो सकते हैं।

जब सरकार को चुकाई गई कर की राशि वास्तव में देय कर की राशि से अधिक हो जाती है, तो आयकर रिफंड दिया जाता है। यह उच्च कर कटौती या अत्यधिक अग्रिम कर भुगतान का परिणाम हो सकता है। आपको इस परिस्थिति में अपने आयकरों की वापसी का अनुरोध करने का अधिकार है।

Income Tax Refund Status Online Eligibility criteria

Taxes you paid during a fiscal year were greater than your actual tax due, you are qualified to obtain an income tax refund tax authorities. There are some pint swhich need to be noted which are mentioned below.

- Self-assessment should be calculated on actual liability of tax.

- Employers Tax Deducted at Source (TDS) deduction exceeds tax liability

- Tax calculation error leading to larger tax payout than actual tax due

- Double taxation money generated abroad

NSDL Refund Status Calculation of Income Tax Refund

You can calculate your income tax refund when you file your IT returns by taking all deductions and exemptions into account.

- Income Tax Refund (ITR)= Total Tax Paid – Total Tax Payable

Refund Awaited Status in ITR 2023

- Please visit incometaxindiaefiling.gov.in.

- Use your USER ID, which should be your PAN number, your password, and captcha code to get into your account.

- Taxpayer need to check View Return tab.

- Find ‘Select An Option’ click ‘Income tax Returns’ option drop-down menu.

- After entering assessment year, submit form.

- To verify progress your ITR refund, click on ITR acknowledgment number.

Steps to file Refund Awaited in ITR

- First step to sign in or register on website.

- Website will inform you are already registered when you enter your PAN number.

- Please seek any relevant material by searching your email “incometax.gov.in”.

- Log in you can remember your password. You need to reset your password.

- Your PAN number also your User ID.

- You can complete majority income tax-related compliances your account after successfully logging.

Important Links For ITR Login 2023

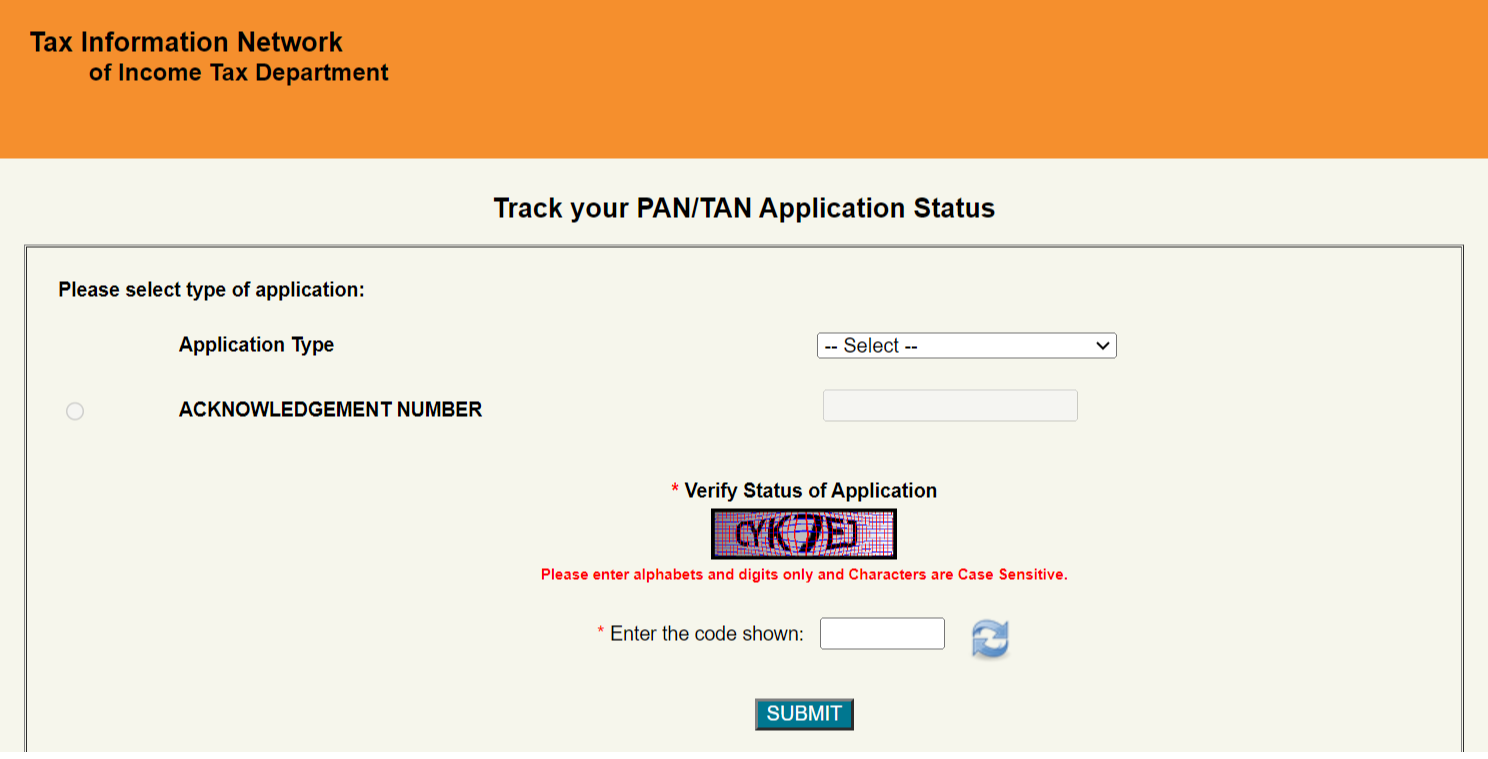

- NSDL Refund Status – Click Here

Taxpayer need usernamen and password for Income Tax Login.

The refund awaited in itr meaning is tax amount which is deducted will be refund soon.

Department takes 20 to 45 days to refund amount in ITR process.